Unlocking the Code: 5 Insider Secrets to Speed Up Your Credit Card Application Approval

Securing a credit card can provide numerous financial benefits and convenience. However, the credit card application process can sometimes be lengthy and frustrating, with uncertain approval timelines. To help you navigate this process more smoothly, we have uncovered five insider secrets that can significantly speed up your credit card application approval. Read on to unlock the code and boost your chances of a swift approval:

- Understand and Improve Your Credit Score: Your credit score plays a vital role in determining whether your credit card application will be approved. Before applying, obtain a copy of your credit report and review it for any errors or discrepancies that could negatively impact your score. Take proactive steps to improve your credit score by paying bills on time, reducing credit card balances, and avoiding new credit inquiries.

- Choose the Right Card: Not all credit cards are created equal, and each card has specific eligibility criteria. Research different credit card options and select one that aligns with your credit profile and financial goals. Applying for a card that matches your creditworthiness improves your chances of approval. Aim for cards that target individuals with credit scores similar to yours to increase the likelihood of a favorable outcome.

- Prepare All Required Documents: Completing a credit card application requires providing accurate and up-to-date information. Gather all necessary documents, such as identification proof, income statements, and proof of address, before starting the application process. Being well-prepared ensures a smooth and quick submission, reducing the risk of unnecessary delays.

- Opt for Prequalification: Many credit card issuers offer prequalification processes that allow you to check your likelihood of approval without impacting your credit score. Take advantage of this feature by submitting basic information and receiving a prequalification offer. If prequalified, you can proceed with a formal application, confident in the higher likelihood of approval.

- Follow Up and Stay Informed: Once you’ve submitted your credit card application, don’t sit back and wait passively. Be proactive and follow up with the credit card issuer to check the status of your application. Stay informed about any additional documentation or steps required and promptly provide the requested information. Maintaining open communication with the credit card issuer demonstrates your eagerness and can potentially expedite the approval process.

Remember, while these insider secrets can enhance your chances of a fast credit card application approval, they do not guarantee instant success. Each credit card issuer has its own evaluation process, and approval timelines may vary. By applying these strategies, you can maximize your potential for a speedy approval and enjoy the benefits of your new credit card sooner.

Also Read: Airtel Payment Bank Account Opening

Fast-Track Your Credit Card Approval: 5 Little-Known Tips for Success

Getting your credit card application approved quickly can save you time and ensure you can start enjoying the benefits of your new card sooner. While there is no guaranteed way to expedite the process, there are some lesser-known tips and strategies that can increase your chances of fast-tracking your credit card approval. Here are five valuable insights to help you succeed:

- Optimize Your Credit Utilization Ratio: Credit card issuers often evaluate your credit utilization ratio, which is the percentage of your available credit that you are currently using. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management. If possible, pay down existing balances or request credit limit increases on your existing cards to lower your utilization ratio. This proactive step can enhance your creditworthiness and improve your chances of speedy approval.

- Leverage Existing Banking Relationships: If you already have a banking relationship with a particular financial institution, consider applying for a credit card from the same issuer. Many banks and credit unions offer special perks or expedited processing for existing customers. By leveraging your existing relationship, you may be able to streamline the approval process and potentially receive a faster decision.

- Consider Retail or Store Credit Cards: Retail or store credit cards are often easier to obtain compared to general-purpose credit cards. These cards are typically tied to specific retailers or brands and offer benefits like discounts, loyalty rewards, or special financing options. Applying for a retail credit card can increase your chances of approval, as they tend to have more lenient criteria and faster application processing.

- Explore Secured Credit Cards: If you have a limited credit history or a low credit score, consider applying for a secured credit card. Secured cards require a cash deposit as collateral, which minimizes the risk for the issuer. Because of this added security, secured credit cards are often more accessible and can provide an opportunity to establish or rebuild your credit. Additionally, some secured card issuers may expedite the approval process since they have the collateral as protection.

- Seek Assistance from a Co-Signer: If you’re having trouble getting approved for a credit card on your own, you can consider enlisting the help of a co-signer. A co-signer is someone with a stronger credit profile who agrees to take joint responsibility for the credit card debt. Their involvement can boost your chances of approval, as the issuer considers their credit history and income alongside yours. However, keep in mind that both you and your co-signer will be equally responsible for repaying the debt.

Remember, while these little-known tips can increase your chances of expediting your credit card approval, it’s essential to approach the application process responsibly. Avoid submitting multiple applications within a short period, as this can negatively impact your credit score and raise concerns among potential issuers. By implementing these strategies wisely and maintaining good credit habits, you can enhance your likelihood of fast-tracking your credit card approval and enjoy the benefits of your new card sooner.

The Power of 5: Top Secrets to Expedite Your Credit Card Application Approval

Obtaining credit card approval quickly can be a significant advantage, allowing you to access credit when you need it and take advantage of various benefits. To help expedite your credit card application approval process, we have identified five powerful secrets that can boost your chances of success. By implementing these top strategies, you can maximize your potential for a swift credit card approval:

- Gather and Organize Required Documentation: Before beginning the credit card application process, it’s crucial to gather and organize all the necessary documentation. Common documents include identification proof (such as a driver’s license or passport), proof of address (utility bills or bank statements), and income verification (pay stubs or tax returns). Having these documents readily available and organized will streamline the application process, minimizing delays caused by missing or incomplete information.

- Double-Check Application Accuracy: Accuracy is vital when completing your credit card application. Even minor errors or inconsistencies can cause unnecessary delays in the approval process. Carefully review all the information you provide, ensuring that it aligns with your supporting documentation. Double-check your contact information, employment details, and financial information to ensure accuracy and avoid potential complications.

- Highlight Stable Employment and Income: Credit card issuers value stable employment and a consistent income when assessing creditworthiness. Emphasize your stable job history and provide accurate details about your income sources. Include any additional sources of income, such as rental properties or investments, to present a comprehensive and favorable financial picture. Demonstrating a reliable income stream can increase your chances of swift credit card approval.

- Optimize Your Credit Profile: Creditors often review your credit history and credit score to evaluate your creditworthiness. To expedite your credit card approval, take proactive steps to optimize your credit profile. Pay all your bills on time, reduce outstanding debt, and dispute any errors on your credit report. Regularly monitoring your credit and addressing any issues can help improve your credit score, making you a more attractive candidate for credit card approval.

- Research and Choose the Right Card: Each credit card has its own set of eligibility criteria and benefits. To expedite your approval, research different credit cards and choose one that aligns with your credit profile. Look for cards that cater to individuals with similar credit scores and income levels to maximize your chances of approval. Applying for a card that closely matches your financial situation can increase the likelihood of swift approval.

It’s important to note that while these secrets can enhance your chances of expediting your credit card application approval, it’s ultimately up to the credit card issuer to make the final decision. Factors such as the issuer’s internal processes, the volume of applications, and other individual circumstances can influence the approval timeline. By implementing these strategies and presenting yourself as a responsible and creditworthy applicant, you can maximize your potential for a fast credit card approval.

Accelerate Your Credit Card Application: 5 Proven Tips for a Swift Approval

When applying for a credit card, it’s natural to want a quick response to start enjoying the benefits. To help expedite your credit card application process and increase your chances of a swift approval, we’ve gathered five proven tips that can streamline the process. By following these strategies, you can accelerate your credit card application and get a faster decision:

- Research and Select the Right Card: Before applying, research different credit cards and identify the one that best suits your needs and qualifications. Different cards have varying eligibility requirements, such as credit score ranges or income thresholds. By choosing a card that aligns with your credit profile, you increase the likelihood of meeting the issuer’s criteria and speeding up the approval process.

- Complete the Application with Accuracy and Detail: When filling out the credit card application, ensure that you provide accurate and detailed information. Any errors or missing data can cause delays or even lead to rejection. Take your time to review each section thoroughly, including personal details, contact information, employment history, and income. Double-check your entries to eliminate mistakes and ensure a smooth and efficient application.

- Opt for Online Applications: In today’s digital age, many credit card issuers offer online applications. Opting for this method can significantly expedite the approval process. Online applications are generally processed faster than paper applications since they reach the issuer’s system immediately. Moreover, online applications often have built-in validation checks that can help you catch errors or missing information in real-time, saving time and reducing the chance of delays.

- Provide All Required Supporting Documents: Credit card applications often require supporting documents to verify your identity, address, and income. To accelerate your application, ensure you have all the necessary documents ready and submit them promptly. Commonly requested documents include copies of your identification, recent pay stubs, bank statements, and proof of address. By providing the required documents upfront, you demonstrate your preparedness and commitment, expediting the evaluation process.

- Follow Up and Communicate: After submitting your application, don’t just wait passively for a response. Take an active role by following up with the credit card issuer. Keep track of the application’s progress and contact the issuer’s customer service or application status hotline to inquire about any additional requirements or updates. Staying informed and communicating with the issuer shows your interest and commitment, potentially prompting them to expedite the evaluation process.

It’s important to note that while these tips can enhance your chances of a swift credit card approval, the timeline ultimately depends on the credit card issuer’s processes and workload. However, by selecting the right card, providing accurate information, utilizing online applications, submitting all required documents, and maintaining open communication, you can increase the likelihood of an expedited credit card application process and receive a quicker decision.

Cracking the Credit Card Approval Process: 5 Secret Tips for Quick Success

The credit card approval process can sometimes feel like a mystery, leaving applicants uncertain about their chances of success and the timeframe for a decision. However, by uncovering some secret tips, you can crack the code and increase your chances of quick success in obtaining a credit card. Here are five insider secrets that can help you navigate the credit card approval process with speed and efficiency:

- Understand Credit Card Issuers’ Preferences: Different credit card issuers have varying preferences and target markets. Research the credit card issuers you are interested in and understand their ideal customer profiles. For example, some issuers may focus on individuals with excellent credit scores, while others may cater to those with fair or average credit. By aligning your application with the preferences of the issuer, you improve your chances of a quick approval.

- Improve Your Credit Utilization Ratio: Your credit utilization ratio is the percentage of your available credit that you are currently using. Credit card issuers pay close attention to this ratio when evaluating your application. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management. By paying down existing balances or requesting credit limit increases on your current cards, you can lower your utilization ratio and increase your chances of quick credit card approval.

- Leverage Prequalified Offers: Take advantage of prequalification offers provided by credit card issuers. Prequalification is a process where the issuer performs a soft credit inquiry to assess your eligibility for their credit cards. It gives you an idea of the likelihood of approval without impacting your credit score. If you receive a prequalification offer, you can proceed with a formal application, confident that you are more likely to be approved. This streamlines the process and can lead to a faster decision.

- Time Your Application Strategically: Timing can play a role in the credit card approval process. Applying during peak periods, such as the holiday season, when issuers receive an influx of applications, may result in longer processing times. On the other hand, applying during less busy periods, like weekdays or non-holiday periods, may expedite the evaluation process. By strategically timing your application, you can potentially receive a quicker decision.

- Consider Credit Unions or Local Banks: While major national banks are popular choices for credit cards, credit unions and local banks can offer a quicker approval process. These institutions often have more personalized customer service and a streamlined application process. They may have fewer applications to process compared to larger banks, resulting in a faster turnaround time. Research local options and consider credit unions to potentially expedite your credit card approval.

Remember, while these secret tips can enhance your chances of quick credit card approval, they do not guarantee instant success. The credit card approval process is multifaceted and depends on various factors, including the issuer’s internal procedures. However, by understanding issuer preferences, optimizing your credit utilization ratio, leveraging prequalification offers, timing your application strategically, and considering credit unions or local banks, you can crack the credit card approval process and increase your chances of a swift and successful outcome.

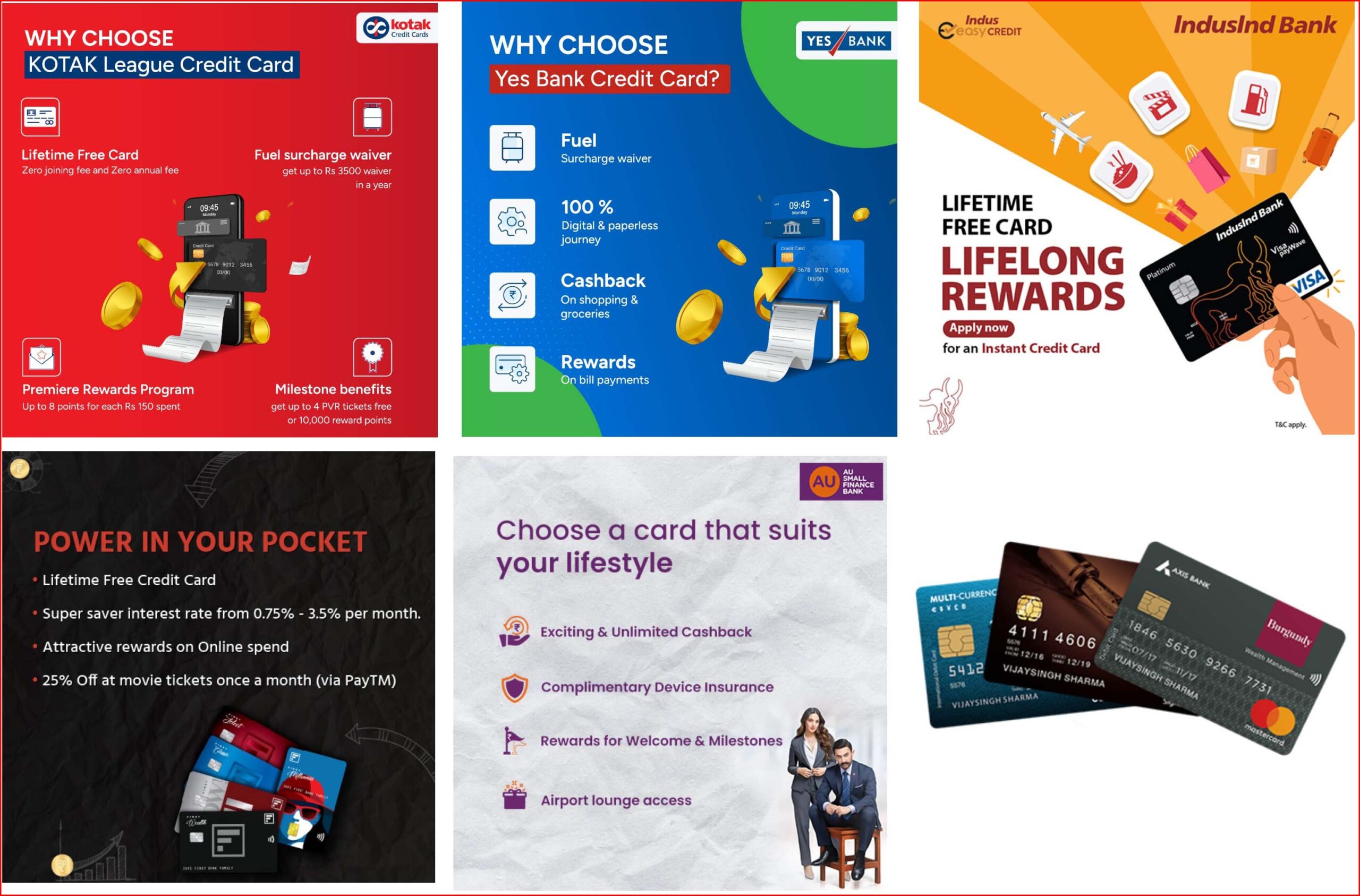

Apply for Credit Card Below Listed Brand for Your Choose

- Apply online for your Lifetime Free IDFC First Bank credit card and enjoy best in class benefits and rewards

2. 💰 Get exciting rewards and cashback benefits

💳 Choose from multiple credit card options

✈️ Get complimentary airport lounge access (select variants)

⛽ Waiver on fuel surcharges (select variants)

3. 🆓 Lifetime Free Card – 0 joining fee and 0 annual fee

🏆 Premiere Rewards Program – up to 8 points for each ₹150 spent

⛽️ Fuel surcharge waiver – get up to ₹3500 waiver in a year

🎟 Milestone benefits – get up to 4 PVR tickets free or 10,000 reward points

4. Choose a card that suits your lifestyle. Apply now for AU Bank Credit Card

✔️ Get Exciting & Unlimited Cashback

✔️ Get free Insurance on mobile purchase

✔️ Get rewards for Welcome & Milestones

✔️ Airport lounge access (limited variants)

5. Open your IndusInd Credit card and enjoy following exclusive benefits –

🏆 Earn attractive reward points and cashback.

🎁 Reward points that never expire – redeem anytime you want

🆓 Indus Easy Credit Card – lifetime free card

✈️ Enjoy complimentary airport lounge access

⛽ Fuel surcharge waiver on all petrol pumps

Experience a rewarding journey with YES BANK Credit Card

⛽️ Fuel Surcharge waiver

📱 100% digital & paperless journey

🛍 Cashback on shopping & groceries

🤩 Rewards on bill payments